Paid and Low-Balance Medical Collections on Consumer Credit Reports

This is part of a series of reports of consumer credit trends produced by the Consumer Financial Protection Bureau using a longitudinal sample of approximately five million de-identified credit records from one of the three nationwide consumer reporting agencies. This report was prepared by Lucas Nathe and Ryan Sandler.

JUL 27, 2022

Introduction

In 2015, the national credit reporting companies announced the National Consumer Assistance Plan (NCAP) as part of a settlement with numerous State Attorneys General, which included provisions for the reporting of medical debt.1 As part of the NCAP, the companies committed to no longer reporting medical collections that were less than 180 days past due and removing medical collections that have been paid by insurance. Both of these provisions were intended to prevent consumers’ credit from being penalized for debts that were not the consumers’ responsibility to pay.

On March 18, 2022, the national credit reporting companies voluntarily announced that they would no longer report certain additional medical collections (Medical Collections Reporting Change). Specifically, the companies announced that starting on July 1, 2022, the time before unpaid medical collections can appear on a consumer’s report will be increased from 180 days to one year, and paid medical collections will no longer appear on consumer reports at all. They also announced that beginning some time in 2023, medical collections with balances below a threshold of “at least” $500 will no longer appear on consumer credit reports.2 These changes have the potential to reduce the amount of medical debt reported on consumer credit reports and to benefit some consumers.

This report explores the characteristics of consumers with reported medical collections and focuses on the current state of medical collections that appear on consumer credit reports and medical collections that are likely to be removed from consumer credit reports in the next year. We use the Consumer Financial Protection Bureau’s (CFPB’s) Consumer Credit Panel (CCP) to analyze collections tradelines first reported to a national credit reporting company after January 2017 with “medical” listed as the original creditor type.3 We observe consumers’ credit scores, census tracts of residence, and other credit information in the quarter prior to the first reporting of the medical collection.

One limitation of our analysis is that medical collection tradelines are not always reported to all three national credit reporting companies. Thus, the CCP does not have complete coverage of all medical collections because the CCP is derived from the credit records of a single company.

The key findings of this report are:

- The removal of collections under $500 as a result of the Medical Collections Reporting Change may have a large effect on the number of medical collections reported, as the majority of medical collections are under that threshold. Moreover, currently on average these collections remain on consumers’ credit reports longer than higher balance collections. However, these collections represent a minority of medical collections balances in dollar terms.

- Removing paid collections is less likely to have a substantial effect, as very few medical collection tradelines are ever marked paid.

- In total we find that about half of all consumers who currently have medical collection tradelines on their credit reports will likely still have medical collections reported once the Medical Collections Reporting Change goes into effect.

- We find that the removal of medical collections will likely be geographically concentrated. Consumers who have medical collections that are likely to be removed are disproportionately more likely to live in states in the north and east of the country. Consumers residing in West Virginia, in particular, stand to have a much greater share of medical collections removed compared to residents of any other state.

- Although consumers with medical collections are significantly more likely to reside in neighborhoods that are majority Black or Hispanic and have lower median income, consumers likely to have all their medical collections removed by the Medical Collections Reporting Change are slightly more likely to live in neighborhoods that are majority white and higher income, compared to all consumers who have medical collections currently.

Characteristics of Consumers with Reported Medical Collections

People rarely plan to take on medical debt. Medical costs are often unforeseen, and billing is confusing and opaque. Ultimately, providers send many unpaid bills to third party collections. Medical debt is the most common type of third-party collection on consumers’ credit reports and the most common type of debt that consumers are contacted about by debt collectors.4 Third-party collectors of medical debt typically have little access to providers’ records. This can make it difficult for people to confirm that the medical debts that collectors contact them about are valid and accurate.

Medical debt collections on an individual’s credit report can impact their ability to buy or rent a home, raise the rate they pay for a car loan or for insurance, and make it more difficult to find or keep a job. Although past research by the CFPB and others suggests that medical collections are less predictive than nonmedical collections of future credit performance,5 many lenders, insurers, landlords, and others rely credit scoring models that treat medical collections as a strong negative signal.

We begin by describing medical collections in the CCP and the consumers who have medical collections on their credit reports. These characteristics are described in Table 1, below. The first column describes all medical collection tradelines; the second column focuses on collections with an initial balance of less than $500; and the last column is limited to collections that are eventually reported as paid.6 Although almost two thirds of all medical collection tradelines have initial balances of less than $500, a very small percentage (2.5 percent) are ever reported paid. The collections in the second and third columns would likely be removed in the coming year due to the Medical Collections Reporting Change.

Consumers with medical collection tradelines typically have low credit scores even before the medical collections appeared, with an average score of 573 the quarter before the medical collection appeared, compared to the national average score of 714. Of these consumers with medical collection tradelines, those with smaller debts and paid collections have higher scores, averaging 579 and 619, respectively. Scores decline by 12-17 points on average in the quarter when the medical collection appears. Medical collections tradelines do not immediately appear on credit reports. Although the CCP does not contain the date of first delinquency (the date when the 180-day waiting period in the NCAP begins), we do observe the opening date, which generally reflects when the collector first acquired the account. Medical collections in our sample were first reported on average about five months after being opened.

Table 1: Characteristics of Medical Collections Appearing on Consumer Credit Reports 2017-2022

| Characteristic | All | Initial Balance Less Than $500 | Ever Paid |

|---|---|---|---|

Consumer Characteristics Quarter Before Medical Collection Reported |

---- |

---- |

---- |

Credit Score |

573 |

579 |

619 |

At Least One Credit Card (Percent) |

56.8 |

61.4 |

81.6 |

At Least One Auto Loan (Percent) |

55.4 |

59.2 |

73.5 |

At Least One Medical Collection (Percent) |

75.3 |

74.0 |

59.7 |

At Least One Non-Medical Collection (Percent) |

52.7 |

51.2 |

35.6 |

No Other Tradelines (Percent) |

1.1 |

1.5 |

0.8 |

Census Tract Percent Black |

17.8 |

17.1 |

12.2 |

Census Tract Percent Hispanic |

17.4 |

16.5 |

13.6 |

Census Tract Median Income |

57,618 |

58,759 |

64,867 |

Age 18-29 (Percent) |

18.8 |

16.9 |

17.6 |

Age 30-44 (Percent) |

35.7 |

34.1 |

35.8 |

Age 45-61 (Percent) |

32.8 |

34.2 |

34.9 |

Age 62 + (Percent) |

12.7 |

14.8 |

11.7 |

Characteristics of Medical Collection |

---- |

---- |

---- |

Ever Had Dispute Flag (Percent) |

5.7 |

4.7 |

7.9 |

Score Change After Collection Appears |

-12 |

-12 |

-17 |

Initial Balance |

788 |

182 |

374 |

Initial Balance Less Than $500 (Percent) |

62.6 |

100.0 |

82.5 |

Ever Paid (Percent) |

2.6 |

3.4 |

100.0 |

Reporting Lag (Days) |

141 |

154 |

128 |

Time on Credit Report (Days) |

512 |

530 |

880 |

Many consumers with medical collections have other credit. About 56 percent of medical collections are associated with consumers who also had at least one credit card account and 55 percent are associated with consumers who also had an auto loan. Smaller balance medical collections are somewhat more likely to be associated with consumers who have other debt. Many consumers who have medical collections had multiple collections, medical and non-medical. About 75 percent of medical collections are associated with consumers who already had at least one medical collection, and 53 percent of medical collections are associated with consumers who had a non-medical collection. Nevertheless, medical collections are not typically the first tradeline of any kind to appear on consumers’ credit reports. Additionally, medical collections tradelines predominantly appear on the credit reports of younger consumers, with only about 12.5 percent appearing on the credit report of consumers age 62 and older, and more than half appearing on the credit reports of consumers younger than 45, likely reflecting differences in insurance coverage across ages.7

Medical collections are frequently disputed, possibly reflecting third-party medical debt collectors having poor information. Almost six percent of medical collections reported in the CCP have a dispute flag at some point. This is almost three times higher than the rate of dispute flags on credit cards and seven times the rate of dispute flags on student loans.8 The rate of dispute flags is somewhat lower for collections with an initial balance below $500.

Persistence of Medical Collections on Credit Reports

The impact of medical debt on consumer credit reports depends in part on how long a collections tradeline continues to appear on a consumer’s record. In principle, negative information such as a collections tradeline can generally remain on a consumer’s credit report for up to seven years, generally the limit under the Fair Credit Reporting Act (FCRA). In practice, many medical collection tradelines drop off consumers’ reports significantly sooner. Less than 20 percent of medical collection tradelines are still on consumer credit reports at the end of four years. The national credit reporting companies do not report information on tradelines that have not been updated with fresh furnishing after a certain period of time, and one of the provisions of the NCAP was to remove collections that have not been updated for more than six months. About four percent of medical collection tradelines are reported initially and then never updated by the collector.

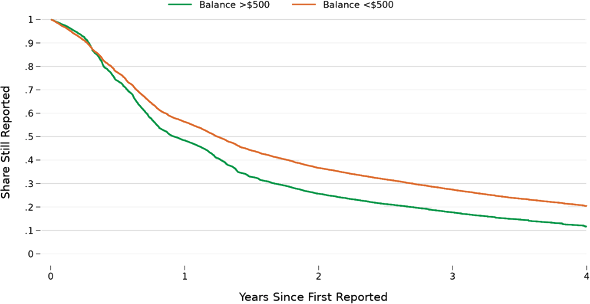

In Figure 1 below, we plot the share of medical tradelines that remain on consumer credit reports over time since initially being reported.9 The Figure shows separate plots for tradelines with initial balances above and below $500.10 One clear pattern is that low balance medical collections remain on credit reports significantly longer than higher balance medical collections.11 For both balance amount categories, the share of medical collection tradelines that are still reported drops quickly in the first few months after the initial report. Only around three quarters of collections above $500 are still reported 180 days later. As a result of the Medical Collections Reporting Change, some of the collections that drop off quickly may never appear at all since the change will extend the grace period for reporting medical collections from 180 days to one year. The Medical Collections Reporting Change may not affect the four percent of medical collections that are reported initially and never updated.

Figure 1: Share of Medical Collections Tradelines That Remain on Consumer Credit Reports Over Time Since First Reported, by Size

Medical Collections Likely To Be Removed in The Next Year

In the coming year, the Medical Collections Reporting Change will remove paid medical collection tradelines and those with initial balances of less than $500. It will also delay reporting of medical collections for a year after the date of first delinquency, up from the 180 days specified in the NCAP. We now examine how consumer credit reports may look after these changes.

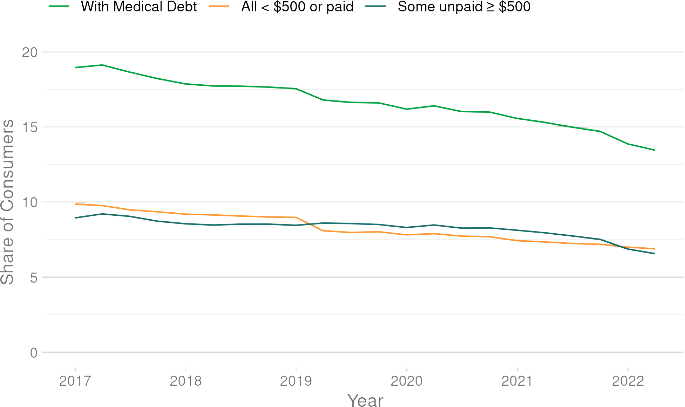

Figure 2 plots the share of consumers who have medical collections on their credit reports over time. In addition to the overall share, the Figure shows the share with only medical collections that are likely to be removed (i.e., all are either paid in full, or had an initial balance of less than $500), and the share who have at least one medical collection that is not likely to be removed.

In 2017, almost 20 percent of consumers had at least one medical tradeline on their credit report. The share has been falling in recent years, likely due in part to reporting changes from the NCAP. Still, at the end of our sample in March 2022, 14 percent of consumers—almost 1 in 7—had at least one medical collection on their credit reports. Over time, the share of consumers who only have paid and low balance medical collections has fallen as well, while the share who have at least one unpaid collection of more than $500 has stayed relatively constant. In March 2022, about half of all consumers with medical collections on their credit reports would still have some medical collections on their credit reports if the Medical Collections Reporting Change were in effect. This would leave about seven percent of consumers overall with at least one medical collections tradeline.

Figure 2: Share of Consumers with At Least One Medical Collection Over Time, Overall And by Whether All or Only Some Medical Collections Are Likely To Be Removed in 2022/2023

Source: CCP.

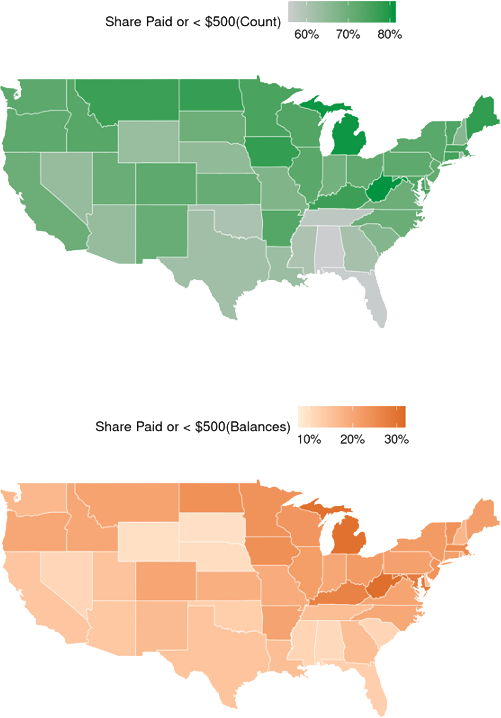

Next, we examine how the likely impact of the Medical Collections Reporting Change varies by state. Figure 3, below, shows the share of medical collections in each U.S. state that will likely be removed by the Medical Collections Reporting Change. The top map shows states shaded by the share of tradelines that will likely be removed, and the bottom map shows states shaded by the share of initial balances that will likely be removed. It is clear from the figure that low balance and paid medical collection tradelines are more concentrated in certain states, with a slight trend toward more collections tradelines being removed in the north and east of the country.

Consumers in West Virginia stand to have the greatest share of medical collections removed. More than 80 percent of medical collection tradelines associated with consumers in West Virginia are likely to be removed. These tradelines represent more than 30 percent of the total balances of medical collections in West Virginia. West Virginia has the greatest share of consumers with at least one medical collection tradeline, and the second highest number of medical collection tradelines per capita, which may explain its outlier status. However, other states with high rates of medical collection tradelines overall rank towards the middle in terms of medical collections likely to be removed.

Figure 3: Share Of Medical Collections Tradelines And Share of Medical Collections Balances That Are Likely To Be Removed in 2022/2023, by Consumers’ State of Residence

Source: CFPB CCP.

Finally, we examine how low balance and paid medical collections are distributed across census tract demographics. Table 2, below, reports the distribution of medical collections, and medical collections likely to be removed, across census tracts categorized by median household income and majority ethnicity of residents in the tract, all as of the end of our sample in March 2022. The first column reports the share of consumers in the full CCP data (not only those with medical collection tradelines) who reside in census tracts in each category, as a baseline. The second column reports the distribution of consumers with at least one medical collection tradeline across the categories, the third column reports the distribution of consumers who will likely have at least one such tradeline removed, and the final column reports the distribution of consumers who have medical collection tradelines but will likely have all their medical collection tradelines removed by the Medical Collections Reporting Change.

Consumers residing in majority Black and majority Hispanic census tracts are overrepresented among those with medical collection tradelines relative to their share of consumers in the CCP overall. For instance, although six percent of consumers in the CCP reside in majority Black census tracts, more than 10 percent of consumers with medical collections on their credit reports reside in these census tracts. Consumers who will have all their medical collection tradelines removed by the Medical Collections Reporting Change are slightly less concentrated in majority Black census tracts than consumers with medical collection tradelines overall. By comparison, residents of majority white census tracts represent a slightly larger share of consumers who will have all their medical collections removed than their share of consumers with any medical collections. As such, consumers in majority white census tracts will likely benefit disproportionately from the Medical Collections Reporting Change, although the difference is small.

Table 2: Distribution Across Census Tract Characteristics of All CCP Consumers, of CCP Consumers with Medical Collections in March 2022, and CCP Consumers Likely to Have Medical Collections Removed In 2022/2023

| Consumer Census Tract is… | Share of Consumers (%) in CCP | Share of Consumers (%) With Medical Collections | Share of Consumers (%) At Least One Medical Collection Removed | Share of Consumers (%) All Medical Collections Removed |

|---|---|---|---|---|

Majority Black |

6.2 |

10.5 |

10.1 |

9.9 |

Majority Hispanic |

10.0 |

11.9 |

11.1 |

11.2 |

Majority White |

75.7 |

70.9 |

72.4 |

72.3 |

Majority Other or No Majority |

8.1 |

6.6 |

6.4 |

6.6 |

---- |

---- |

---- |

---- |

---- |

Median Income $0 – $40K |

13.1 |

21.6 |

20.8 |

19.8 |

Median Income $40K– $60K |

29.7 |

37.9 |

38.0 |

36.9 |

Median Income $60K– $90K |

33.0 |

28.7 |

29.3 |

30.1 |

Median Income $90K+ |

23.3 |

11.6 |

11.7 |

13.0 |

Turning to the second part of Table 2, we see that although consumers in the CCP overall are distributed roughly evenly between the median income categories, with about a quarter of all consumers in each, reported medical collections are concentrated disproportionately among consumers who reside in census tracts with lower median income. For instance, while 13 percent of consumers in the CCP reside in a census tract with median income below $40,000, more than 21 percent of consumers with medical collection tradelines reside in those census tracts. At the same time, consumers whose medical collections will likely all be removed by the Medical Collections Reporting Change are slightly more likely to reside in higher income census tracts compared to all consumers with a medical collection. Residents of census tracts with median income above $90,000 represent 11.6 percent of consumers with medical collections but 13 percent of consumers who are likely to have all their medical collections removed by the Medical Collections Reporting Change.

Conclusion

This report shows that a substantial share of medical collections currently reported on consumer credit reports likely qualify to be removed under a change recently announced by the national credit reporting companies. The Medical Collections Reporting Change seems likely to both reduce the current stock of medical collections being reported, and implicitly reduce the amount of time that medical collections are reported, since low balance medical collection tradelines historically have been more persistent on consumers’ credit reports than higher balance medical collections. Further research will be needed to confirm how credit reporting of medical collections changes over the next year. The Bureau will continue to analyze how the Medical Collections Reporting Changes may affect consumers.

Footnotes

- See e.g. https://www.ohioattorneygeneral.gov/Media/News-Releases/May-2015/Attorney-General-DeWine-Announces-Major-National-S and https://ag.ny.gov/press-release/2015/ag-schneiderman-announces-groundbreaking-consumer-protection-settlement-three .

- See “Equifax, Experian, and TransUnion Support U.S. Consumers With Changes to Medical Collection Debt Reporting”, March 18. 2022., Press Release. Available at https://newsroom.transunion.com/equifax-experian-and-transunion-support-us-consumers-with-changes-to-medical-collection-debt-reporting/ (Accessed May 17, 2022).

- The CCP is a 1-in-48 deidentified longitudinal sample of credit records from one of the nationwide consumer reporting agencies. We choose this period to focus on the state of medical collections after the implementation of NCAP. One provision of NCAP was that the national credit reporting companies agreed to require all furnishers of collections tradelines to report the type of the original creditor, such as medical. Prior to January 2017, about a quarter of all collections tradelines cannot be identified as medical or non-medical, because the original creditor type field is blank.

- See Consumer Financial Protection Bureau, “Consumer Experiences with Debt Collection: Findings from the CFPB’s Survey of Consumer Views on Debt,” (January 2017). Available at https://files.consumerfinance.gov/f/documents/201701_cfpb_Debt-Collection-Survey-Report.pdf

- See e.g. Kenneth Brevoort and Michelle Kambara, “Data point: Medical debt and credit scores,” Consumer Financial Protection Bureau Data Point

- We define tradelines as paid if they have the status “Paid/Was a collection account, insurance claim or government claim.” This is a somewhat restrictive definition of payment and does not count collections that have been settled for less than the full balance, have partial payment, are included in bankruptcy, or have a zero balance without that status code.

- See e.g. https://www.healthaffairs.org/doi/10.1377/hlthaff.2018.0349 .

- See Ryan Sandler, “Consumer Credit Trends Report: Disputes on Consumer Credit Reports,” (November 2021). Available at https://files.consumerfinance.gov/f/documents/cfpb_disputes-on-consumer-credit-reports_report_2021-11.pdf

- More precisely, the figure shows the Kaplan-Meier survival rate over time since first being reported, which accounts for some forms of censoring. Censoring occurs in our data where we do not know how long a tradeline will eventually be reported for because it was still reported in March 2022 when our sample data end.

- After the Medical Collections Reporting Change is in effect, medical collections will also drop off consumers’ credit reports when they move into paid status. However, so few collections ever have this status, that it makes very little difference for the share of collections that would still be reported at any given duration after initially being reported.

- A number of factors in the medical collections market likely explain this pattern, including that larger balance collections are more likely to be the product of medical bills that are ultimately covered by insurance, whereas smaller balance collections are more likely to stem from deductibles or co-pays. Since the NCAP, collections paid by insurance are removed by the national credit reporting companies.