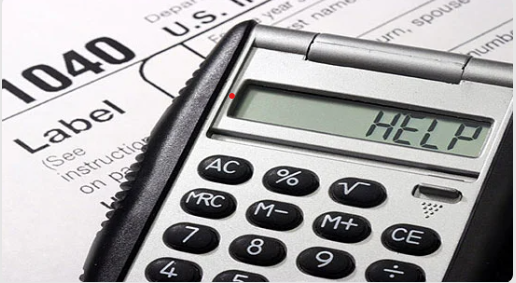

As a Veteran, you may be eligible for certain tax benefits under the tax code. It’s important to file your taxes before this year’s April 18 deadline and be aware of the benefits that apply to you.

Here’s a summary of some of the key tax benefits for military Veterans provided by accountant and tax expert Lisa Greene-Lewis of TurboTax. And don’t forget: Tax advice that applies to civilians can benefit you too.

Federal Taxes

- Military retirement pay is taxable as federal income tax and is not considered earned income for Social Security tax purposes.

- Premiums for the Survivor Benefit Plan are excluded from taxable income.

- Veterans education benefit payments received through VA for education and training are tax-free.

- Disability benefits received from VA, such as disability compensation, pension payments and grants for home modifications, are not taxable.

Money from VA that is not taxed

- Interest from VA life insurance policies.

- Benefits under a dependent-care assistance program.

- Money paid to a survivor of a member of the armed forces who died after Sept. 10, 2001.

- Payments made under the compensated work therapy program.

Note that if you had a recent increase in your disability rating or were granted combat-related special compensation, you may be eligible for a tax refund, but this can only be applied to the year VA reassessed your disability level.

State Taxes

- States typically offer tax benefits only to Veterans who were honorably discharged or released from active duty under honorable circumstances.

- State benefits usually include exemptions on property taxes, according to value.

- Benefits are often transferred to a spouse or surviving spouse of honorably discharged Veterans.

- Many states offer property tax exemptions and other benefits for disabled Veterans.

- Military retirement pay may be taxed differently in different states.

- Every state’s revenue website outlines state benefits for Veterans and how to apply for them.

Disabled Veterans can qualify for property tax exemptions at the state level. These breaks, which are usually tied to a specific disability rating, can help a Veteran save thousands of dollars. You can view a list of all property tax exemptions by state and disability percentage here.

AARP Tax-Aide

- AARP Foundation’s Tax-Aide program offers free tax help to anyone, with a focus on taxpayers who are 50 and older and have low to moderate incomes.

- Tax assistance is available through knowledgeable volunteers, either in-person or virtually, by appointment only.

To find out about more tax breaks for Veterans, read the full version of this article from AARP. It also includes state specific tax break for Veterans.

Topics in this story

More Stories

Bridge My Return launched a software re-build to its hiring platform with an improved AI-driven, skills-matching algorithm and military skills translator.

The Project Flaunt Hub is an online platform of videos, interactive programs and activities. It is designed to empower children, their families and/or caregivers to accept themselves and in doing so, embrace others.

Power of motorsports and road course endurance racing to provide adrenaline therapy and create positive change in the lives of veterans and first responders.

I really appreciate it because veterans should be given more tax cuts at consumer stores as well.

I AM TURNING (67) IN JULY AND RECIEVING A DISABILITY PENSION SINCE 1979 FROM D.O.D. BEEN WORKING FOR THE VA. SINCE 1981. I BEEN PAYING TAXES ON IT SINCE THE BEGINING. I HAVE BEEN RECIEVING A 1099R EVERY YEAR . THE QUESTION IS I’M I ENTILED FOR ANY TAX RELIEF?

im hearing that there is problems with turbo tax. there is a third party company that’s paying refunds

are dependent VA education benefits non-taxable

Very helpful. Thank you.

Great veteran information.

Hello,

In the Feb. 8, 2023 edition, the article

It’s Tax Season: Learn How You Can Maximize Your Benefits and Refunds

As a Veteran, you may be eligible for certain tax benefits under the tax code. It’s important to file your taxes before this year’s April 18 deadline. Check out this summary of key tax benefits for Veterans.

When I look at this is states that some states, as shown below.

State Taxes

States typically offer tax benefits only to Veterans who were honorably discharged or released from active duty under honorable circumstances.

State benefits usually include exemptions on property taxes, according to value.

Benefits are often transferred to a spouse or surviving spouse of honorably discharged Veterans.

Many states offer property tax exemptions and other benefits for disabled Veterans.

Military retirement pay may be taxed differently in different states.

Every state’s revenue website outlines state benefits for Veterans and how to apply for them.

Does any of this apply for the state of Minnesota Veterans? Any help or suggestions would be appreciated.

I am a Minnesota Veteran with 2 yr US Army, plus 24+ yr US Army Reserves.

Thank you,

Carl Wieman

SFC Retired

I’m USMC even six months I have put in for non-tax-exempt for my house which is paid off. I received a notice that I must pay $5000. I am looking for a person to represent me because I am hundred percent vet disabled and I have tried talking to the city, and I’ve called I’ve sent papers. I have documentation that I’ve sent information to them and the lady Mrs. Franklin told me that OK you’re fine and the next thing I get these papers from an attorney Santa oh5000 $ worth of taxes for my house if it’s anyone who can help me with the situation I really would appreciate it if you’re giving me 10 days to come up with this $5000 which I don’t have I am fasting health Thank you.

Dear VA NEWS,

First, thank you for posting information. Secondly, I think you folks need to re-structure the way you portray information. If it isn’t obvious, most of the comments below are folks who think this is the place to ask TAX questions. Although many who are confident in finding information on the internet, you need to remember the vast majority of your Veteran audience aren’t. Be upfront in your posts about what you the VA offer and what steps folks need to take for State or Fed TAX questions. I think you’ll find that much of the anger pointed at VA communications is because the audience simply doesn’t understand what you are telling them. Just my two cents from a Veteran son aged 50+ who has to explain stuff on the internet to their mother 80+.

why doesn’t the VA provides Tax-Aide program for veterans ? why do veteran have to drive hundreds of mile to military installation or pay hundreds of dollars for taxes to be file

“States typically offer tax benefits only to Veterans who were honorably discharged or released from active duty under honorable circumstances.”

WHat states and where do I find info on this?

Can the VA send an application to join and if so, would you send one? I retired Jan 1, 1991, with 30 year’s service not thinking I needed one.

Should this information not have been distributed a month ago before people had a chance to get their taxes filed?

[Editor: There is still more than two months until taxes are due.]

The article states military retirement pay is not considered for social security income. I use TurboTax and it includes the Military retirement as income on the Social security worksheet. I’m paying tax on Social security income at 85% level because of Military retirement income. How do I get it excluded?

Do expenses related to military reserve duty qualify for tax exemptions if a member selects standard deduction?

Greetings,

I am receiving 30% disability payment for service connected medical conditions.

Are the payments taxable?

Disability benefits received from VA, such as disability compensation, pension payments and grants for home modifications, are not taxable.

This is an excerpt from the article.

no, under the first section, Federal taxes, the last line states “Disability benefits received from VA, such as disability compensation, pension payments and grants for home modifications, are not taxable.”

No they are not taxable.

Is there anyway a 100% disabled Veteran can stop SSDI from being taxed?

I don’t get mine taxed and I live in Wa. State. I am not sure as to your area. But best bet is to attempt to get ahold of them. Or talk to a tax person about it. I see that as being all wrong. You being taxed again on money you have paid taxes on.

Hey buddy! As far as I know, if your total income, including SSDI and any other incomes, is not above the set threshholds, you should not be taxed. SO the trick would be to get your incomes down to the level taxes would not be due. OR, if you are making more than what is taxed, let it go! I do not think being 100% disabled makes any difference. It is income based.

Here is the IRS page link:

https://www.irs.gov/newsroom/dont-forget-social-security-benefits-may-be-taxable

Hope that helps.

It would be so nice that disabled veterans be excluded from paying property tax as a whole.

In some states that is the case, depending on level of disability. Texas is an example.

Am I able to receive help on information as a Vet how to file my taxes?

My husband is 100% permanently disabled. We get a fairly good property tax break, but it is far from paying no taxes. I appreciate the current tax break, but I also feel he paid heavily for his country, and deserves every break he can get. I am appalled our airport (Tyson McGhee), does not offer a veteran discount for parking. I have approached them on several occasions, but have been brushed off. I am simply asking for a discount, not a freebie, for a veteran with a government photo ID. This airport is adjacent to the military airbase. I would think this would be of importance.

Yes it definitely would be great. We lived in Arkansas for two years and they do not

charge Disabled veterans property tax. Why can’t other states follow their lead?

My husband is 100 per cent disabled from combat infantry and agent orange. He

should not be charged any tax for defending his homeland and having to live in pain

for the rest of his life every single day.

Amen, I hear you there. But that would definitely take an act of congress to make that happen.

VA authorized travel pay for disabled veterans is not taxable.

A lot of questions about state taxes/property tax discounts can be answered by the individual’s Local State VA office/local county tax office. Your local state VA office can also help you with Federal veteran benefits. All states are different in offering veteran tax breaks. For free filing/assistance with filing taxes-VITA(Volunteer Income Tax Assistance) is a good one. Just google free tax assistance. Also, some states do not tax your military retirement.

If you want to obtain first responder information on this board, at the very least, INDICATE the State in which you RESIDE. While VA disability requirements are standard everywhere, the many additional benefits available in individual states and even counties VARY quite a bit from state to state. So, WHAT STATE DO YOU LIVE IN?

Thanks for the information

Live in San Antonio area csn you I’m retired Army 100% disabled need help getting someone with military experience doing taxes. Last year I made mistakes and had to pay over $4000

Hey George, try calling the Military and Veteran’s Service Center :210-335-6775. I’m sure they can point you in the right direction. Most tax assistance is free.

Is there a military base near you?

If there is, they normally have folks will do them for you

I want to know if Arizona give property tax exemption for veterans. I was released under honorable conditions. Please advise.

Get off your lazy ass and read the info on your states exemptions for veterans

Hey, watch what you say and how you say it. Show some respect for a fellow veteran. Maybe helping the person figure out where to find the information would be better than criticizing and calling names.

I am a lifelong resident of Ohio in Lake County. My disability is at 60%. I was in the Army (1967 to 1969) Vietnam during the 68 TET offensive. I was wounded in combat (Purple Heart). Honorably discharged in 1969. Would I qualify for any property tax discounts?

https://dvs.ohio.gov/veteran-benefits/benefits-resources/taxes

Homestead Exemption

In order to qualify for the exemption, you must be a veteran of the armed forces of the United States, including reserve components thereof, or of the National Guard, who has been discharged or released from active duty under honorable conditions, and who has received a total disability rating (100%) or a total disability rating for compensation (100%) based on individual unemployability, for a service-connected disability or combination of service-connected disabilities. Visit your local county auditor to apply.

This is just a News Article providing the information shown, not a Tax Service of any kind. The article does link a couple of services that can advise, i.e. – https://taxaide.aarpfoundation.org/

Thanks; very helpful

You might at least mention AMAC the other Senior Association for those that don’t have a liberal leaning.

I’m a 70% disabled veteran, joined the army from 1976 to 1997, is there any chance of tax relief or free tax assistance for me.

First check what state VA benefits are/may be available, for your state. Depending on your age/income, there may be. Google free tax assistance and see what pops up. Since you are rated at 70% by the VA, you should look and see if you might meet the criteria for VA Individual Unemployability (IU). Make an appointment with your State VA office and talk with them.

Go to Military ONESOURCE you can download free tax software: https://www.militaryonesource.mil/financial-legal/taxes/miltax-military-tax-services/

I don’t use this software personally so I can’t endorse it but if you don’t have a complicated tax return it is worth a try. Another option is using IRS fillable forms on the IRS website: https://www.irs.gov/forms-instructions Most states have forms on their state website.

I recieve 13% va, calpers & ssdi. moved from socal to gj, co.

thru h&r cost is $300 to get my taxes done b/c I moved. thats a 1st.

I heard the VA does taxes for free.

I am honorably discharged from active duty in the Gulf of Tonkin with 60% disability. I have recently moved from TN to NC. Can you tell me my tax situation in NC? Ron Hubbard

[Editor: Do NOT publish your sensitive personal information on the internet. I have removed it from this comment.]

love your book on Dianetics Ron!!

I am 100% VA Disability rated. Hw do I get my property tax adjusted?

In Texas, you get in touch with your county tax office. It’s fairly easy.

Search your state, county or parish for Disabled Veterans Benefits. In Texas, 100% is zero property tax. Below 100% is on a chart.

Why are you using third party tracking sites?

Like your article

At this time I have two service connected disability 30% heart related 30% pdst total of 50%

I’m in the process of trying for more

I’m in Colorado Morgan county talk to them about property tax they say I need to be 100% disabled to get tax reduction

Thanks for all the good info.

Check in your state for this year on retirement income for tax purposes – OK as of 2022 no longer taxes retired Military pay as part of regular income for tax purposes !

GREAT INFO, THANKS

I HAVE RECEIVED A 100 % DISABILITY PAYMENT AT 94 YEARS OF AGE AND WITH FULL SOC. SEC. PAYMENTS FOR MY WIFE AND

I, IT PUTS ME INTO AN INCOME BRACKET THAT WILL TAKE A GOOD PORTION FOR TAXES IWOULD LIKE TO KNOW IF IF EITHER SOCIAL SECUYITY AND THE DISABILITY PAYMENT ARE TAXABLE?

I’m pretty sure that the Social Security is taxable. However, the disability payments are not viewed as income on a taxable basis. Hope this helps.

Your Social Security payments are only taxable above a certain level. If you haven’t had to pay in the past, it shouldn’t change. Like the article says, your disability payments are not taxable.

Your VA benefits are not taxable per the article above. Social Security looks at your combined income. If you do a google search for the Social Security Retirement Pamphlet, you can look at pages 11-12 and it will tell you what SSA is looking at.

Jack, your VA Disability income is not taxable. Your Social Security is taxable.

You’re the best source of info for veterans I have found. Thank You!

Seems like every time I use the more popular online tax services, I go through about 10 minutes of vetting questions then they kick me out and say I cannot file since I live in the Philippines. Whaaaa? What does it matter where I live? Jheez.

Know of any of these (pref FREE) services that don’t exclude US Veterans because we choose to live in another country? We still pay taxes, we (in my case) still hold our US Passport as our default Passport, regardless of any other shared national identites.

Have you tried the free filing through the IRS web site?

I’m a 100% disabled veteran from Jacksonville, Arkansas and I never received the 3rd stimulus check are there any services that will help me file for the check

I want to know if Arizona give property tax exemption for veterans. I was released under honorable conditions. Please advise and thank you per request

Not too helpful for a Cold War veteran who served overseas in areas where other countries were at war but no physical threat to myself

What about sales tax on a new car ? New York State, Cattaraugus county

Are these property taxes that are exempt for disabled veterans on their house, can be filed to get back money only if you work? Or can they be filed without having a job if you’re 100% disabled veteran? I’ve been getting property tax exemptions since 2021.

Thank you.

I bellieve the VA should have recognized the drafter army soldiers for the war that killed so many soldiers for the sake of this government to make money. How many soldier with a US prefix number died for such a worthless was. They did not want to give two years of their lives without a choice. These soldiers should be recognized for their sacrifice. There were no bands and people waiting for their return home.

i am a 30% disabled vet with an Homorable discharge. I live in SC since May 2022 and Ohio before that; what taxes benifet do these states offer.

Thanks. Had AARP do my taxes this year and they did a great job

Did you have to be AARP member for them to do your taxes??

As my husband is a Vietnam veteran and receives disability benifits and is blind is there someone who can help us file our taxes?

I’m in Tampa and it’s free to get taxes done on MacDill AFBASE.

Thank you for the tax information.

Thanks for the overview. It comes at a good time for Veterans. The importance of filing yearly taxes can’t be over emphasized especially during Challenging Times.

It’s not as good as the article says

Thank you. It’s helpful information.

Thanks! Were might I find addresses for AARP tax counselors . i live in Louisville, KY.

Again, thank you

George Rojan

Arizona doesn’t give the property tax breaks to just any disabled Vet, they decide who gets a waiver and who doesn’t

This is great advice .. I live in Florida and as a 100% Service Connected Disabled Vet I save over $7000 per year on taxes on my home & I get a huge discount on my Auto Registration. Every state is different, but not investigating this could cost you allot of money.

What are the tax benefits for the State of Ohio? My husband has a 10% disability.

Turbo tax program has gliches that cannot be corrected and makes paper filing necessary, prevents your ability to overide and file electronically.

we did it and the Va was not charged and we didn’t have to pay using Vita because they offer it free to people over 60 so it worked well for us and we don’t have to pay a thing but not much back

Ive tried for years to get tax break in my county. They tell me to turn in paperwork before by a certain date. Then I take tyem and they tell me it was the day before. This has happened a few times

Here in Corrupticut we get a $1,000 or $5,000

property tax exemption,hopefully is has gone up,

but I wouldn’t bet on that.

whats it cost for Life Insurance from V A

Timothy, Like anything else there are several options and the cost is determined by several factors. I recommend you visit the link below for more information.

https://www.va.gov/life-insurance/options-eligibility/

Can i go to Court House in my county for a tax break

Contact your counties Auditor and provide tax documents for at least two years. I have to wait until 2024 to claim a property tax exemption on a house I bought in August.

I had the same issue, but the county refunded all, backdated to the date on my disability letter.

What tax company can I go to help me? I haven’t had to file for a long time because I didn’t make enough to file. Now that I have a house, I didn’t know that I could get some of my property tax back.

i need this info also

Probably not. Standard deductions will more than interest deductions in most cases.

Probably not. Standard deductions will surely be more than itemized interest deductions in most cases.

There’s a company called FreeTaxUSA. Very good format and very easy to use.

I’m a senior citizen and veteran in Milwaukee Wisconsin. Free tax preparation is being done at several for veterans at Milwaukee senior centers. If you’re a veteran, check to see if senior centers are in your area and call one or two of them.

Thank you. What applies to a widow of a 100% veteran living in CAL-VETERANS HOME with her husband when he died and continues to reside there. Does anything helps her with her tax situation?

The property tax relief is a state policy, mostly for disabled veterans. You should contact your county Veteran’s Service Officer or auditor. Good luck!!!

I have used a tax prep software for years and it does it all for you. Just read everything close and answer accurately. H&R Block and Turbo Tax are the 2 I have used with zero issues.