Servicemembers, arm yourself with basic car buying skills—How to shop for auto financing

It’s not very much fun when you land at your first duty station with no groceries in the fridge, no idea where to get food to eat, and no car to get around. Asking for a ride can be a pain and many bases have limited public transportation options. If that sounds like you, you’re not alone.

Many servicemembers buy or lease a car shortly after joining the military. Unfortunately, we hear from many servicemembers who didn’t fully appreciate the woes of high rates and other unaffordable terms when they signed their auto financing contract.

Before you rush off to the nearest car dealer advertising “Military – low payments, no interest, or zero down,” let us arm you with some basic car buying and car financing skills.

Over the next few weeks the Bureau of Consumer Financial Protection (BCFP) and the Federal Trade Commission (FTC) will share information highlighting things you should know when you’re thinking about getting a car.

Shop for the best financing deal

You might think that the first step in buying a car is to go to a dealership. If you plan to finance your purchase, however, you may save money by making your first step to shop for auto financing. If you decide to finance your car, you may obtain better terms by considering several financing sources in addition to dealership financing.

Shop around for financing terms by contacting multiple banks and credit unions and compare these offers to what the dealership offers. Obtaining financing directly through your bank or credit union may get you lower rates, but is not a guarantee. It’s possible you can qualify for an even lower rate if you have automatic payments taken out of your account. Automatic payments can help ensure your payments are made when due but it is still helpful to check statements regularly, when possible, to ensure proper payments (and not extra amounts) have been made. You should also ask about any military specific discounts that may be available.

Take the time to fully understand the terms, conditions, and costs involved in financing a car before you sign a contract. Know that the total amount you’ll pay depends on several factors.

Two important things that you should pay close attention to are:

- Annual percentage rate (APR)

- Length of the financing

Annual percentage rate (APR)

It’s important to consider the APR when comparing auto financing offers. A lower APR will lead to significant savings in the long term. For example, a three-year $15,000 financing contract with a 5 percent APR, and payments of $450 monthly, would save you about $500 overall compared with a three-year, $15,000 contract at 7 percent APR.

To negotiate the best APR, it’s wise to check your credit reports before looking into options. This information lets you assess how lenders are likely to view your creditworthiness. Make sure that your credit reports don’t have any errors, and if they do, you should take steps to correct them. Errors on your credit reports can reduce your credit scores and can mean you get charged a higher rate or even have your financing application denied. Better credit will help you secure a lower rate and reduce the amount of money that you end up paying. Looking up your credit scores in advance allows you to research the average rate for someone with a similar score. You can use that rate as a basis to properly budget for a car you can afford.

Length of financing

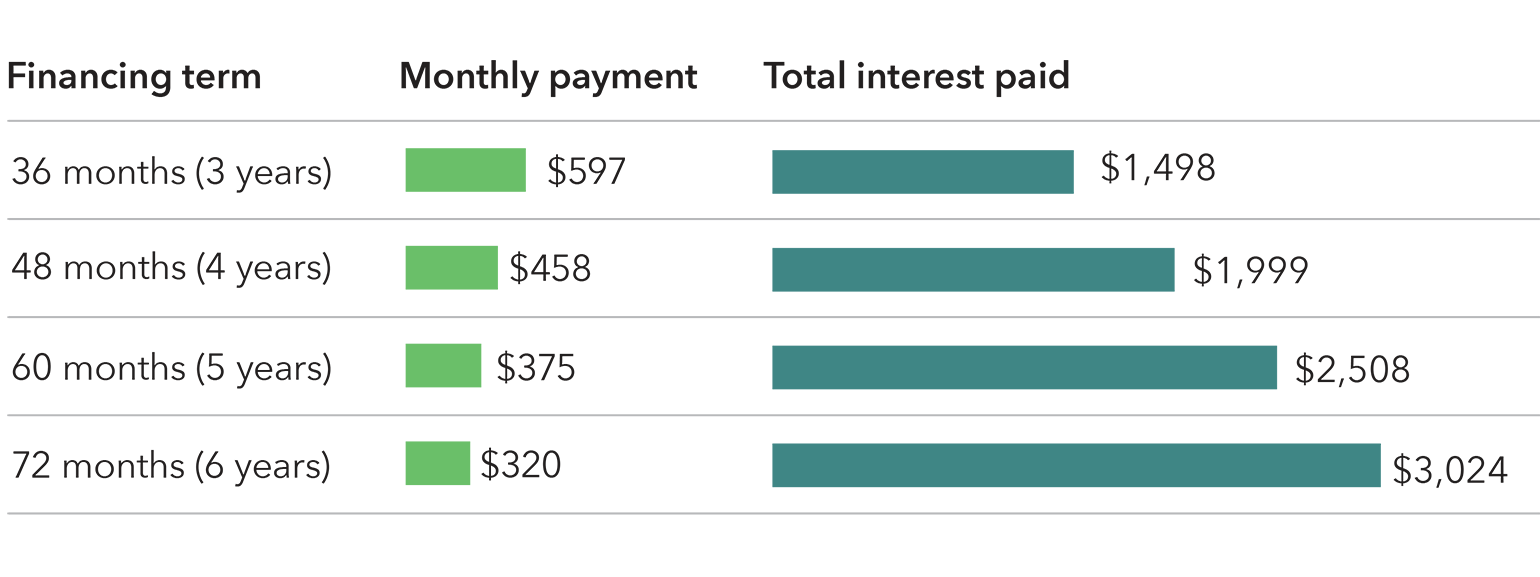

When comparing your offers and negotiating financing, it’s important to know if you can afford the monthly payment, but be sure you look at the total cost of the financing. A smaller monthly payment may mean the financing extends over a longer period of time—72 months or more, instead of 36, 48, or 60 months.

Try to keep the length of your financing as short as your budget can afford. The sooner you’re able to pay off the car, the less interest you'll pay. For example, you can see in the figure below how a lower monthly payment over a longer term increases your total cost. This example assumes $20,000 financing and an interest rate of 4.75 percent.

You should still consider putting cash down when purchasing a car. Cash down helps lower your payment and lenders may provide lower rates depending on how much cash you can put down.

If you’re going to get car financing, start by thinking through what you can afford, check your credit report, then shop around, paying attention to the total amount you will pay.

This is the first post in our blog series written in collaboration with the FTC. Read the other three posts in the series on making the decision to buy a new or used car, how to trade in your car, and standing your guard when it comes to add-on products. Learn more about auto financing and the car buying process at www.FTC.gov/cars and at www.cfpb.gov/auto-loans.