(The Center Square) - The Washington Secretary of State’s Office has certified an initiative that, if approved by voters in November, would repeal a 2021 tax imposed on income derived from the sale of capital gains.

Initiative 2109 would repeal a 2021 law enacted by the Legislature that imposes a 7% tax on the income from an individual’s long-term capital gains that are above a certain threshold. The tax was challenged in court and ultimately upheld by the state Supreme Court last year. The U.S. Supreme Court recently declined to take up a lawsuit filed in federal court arguing the tax violated the U.S. Constitution's Commerce Clause.

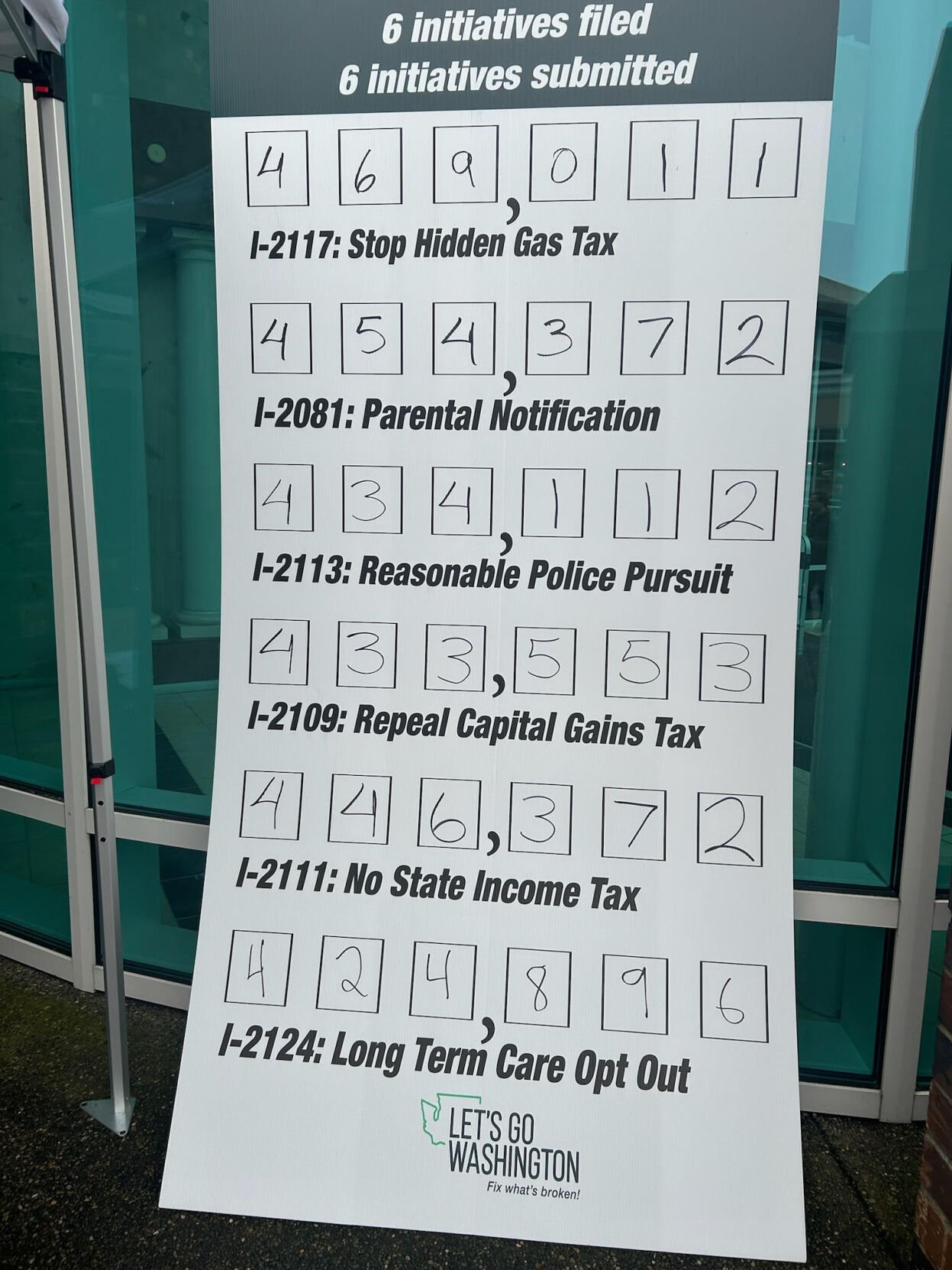

The initiative was filed by State Rep. Jim Walsh, R-Aberdeen, while the signature gathering effort was spearheaded by voter advocacy group Let’s Go Washington.

The organization’s founder Brian Heywood wrote in a press release statement that “not only does the income tax on capital gains not support of the law or voters, but in their own words, it’s a foot in the door for a statewide income tax. They’re already planning to expand the tax and target more small business owners, family farms, entrepreneurs and restaurant owners. It’s time to shut the door on this for good.”

In response to the initiative’s certification, Washington Budget and Policy Center Executive Director Misha Werschkul wrote that “advocates fought to pass this smart, commonsense policy for more than a decade because we know how essential our tax code is to advance racial and economic justice. I-2109 is just another strategy by the ultra-wealthy to avoid paying what they owe.”

Let’s Go Washington has also turned in signatures for several other initiatives that would:

- restore pre-2021 state law regarding police vehicular pursuits (already certified);

- repeal the state’s cap-and-trade program (already certified);

- provide parents and guardians with a right to review educational materials, receive certain notifications, and withdraw from certain sexual health education programs (already certified);

- allow certain people to opt out of the state's mandatory long-term care tax; and

- eliminate an income tax at any level in Washington.